Waza Launches Lync: A Game-Changer for African Startups’ Cross-Border Payments

In a groundbreaking move for Africa’s fintech space, Y Combinator-backed startup Waza has unveiled Lync, a cutting-edge cross-border banking solution aimed at empowering African startups with seamless international transactions. The launch comes at a critical time when African businesses are facing increasing challenges with global payment platforms.

What is Lync?

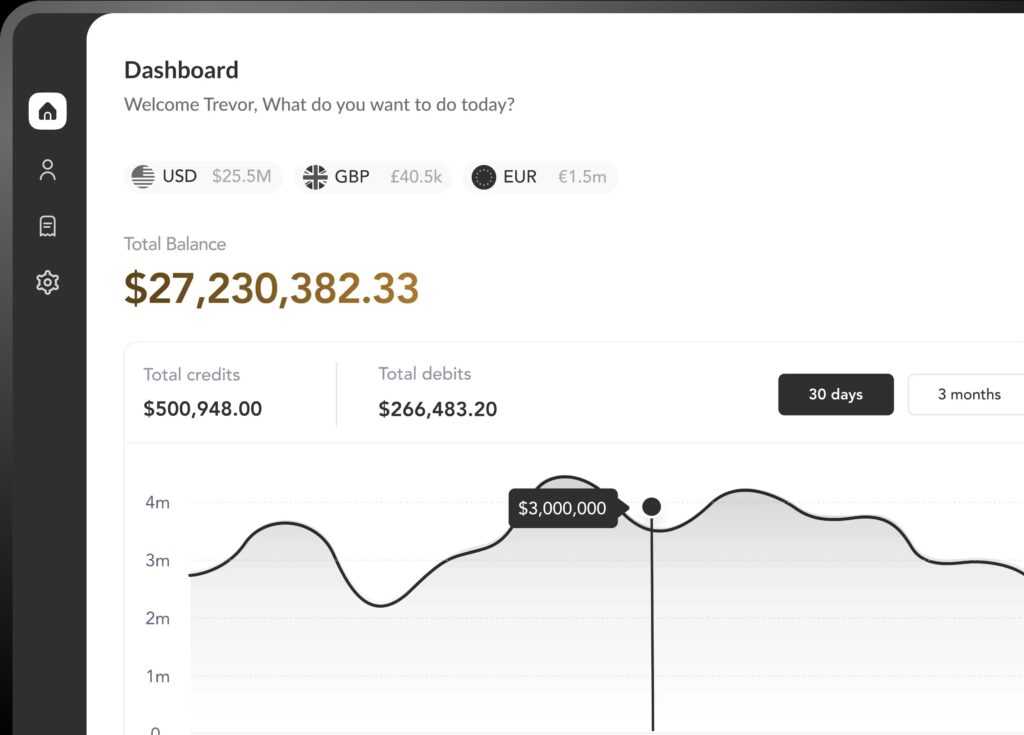

Lync is designed to enable African businesses to transact effortlessly in over 100 countries using multiple currencies, including USD, EUR, GBP, NGN, and even stablecoins. Unlike many competitors that rely on wallet-based systems, Lync provides direct banking access, simplifying reconciliation processes and reducing operational complexities.

Addressing a Critical Need

African startups have long struggled with payment processing issues, especially in light of recent restrictions imposed by global banking platforms such as Mercury. Waza’s Lync aims to fill this gap by offering a cost-effective and efficient alternative tailored to the unique needs of African entrepreneurs. With features such as multi-currency support and direct banking integration, Lync provides businesses with the financial flexibility they need to scale globally.

Key Features of Lync:

- Seamless cross-border transactions in over 100 countries.

- Support for multiple currencies, including USD, EUR, and NGN.

- Direct banking integration, avoiding the need for wallet-based solutions.

- Competitive pricing tailored to African startups.

- Compliance with global financial regulations to ensure secure transactions.

The Future of African Fintech

As African businesses continue to expand beyond borders, innovative solutions like Lync are crucial for ensuring financial inclusivity and growth. Waza’s move underscores the increasing demand for localized fintech solutions that cater to the continent’s dynamic business landscape.

With Lync, African startups can now focus on scaling their operations without being hindered by cross-border payment hurdles. The solution is expected to boost trade, investment, and economic integration across Africa and beyond.

Waza’s launch of Lync marks a significant step forward in revolutionizing cross-border payments for African startups. As the fintech ecosystem continues to evolve, solutions like Lync are set to empower businesses, foster economic growth, and bridge financial gaps in the region.

Interesting Read: https://africansights.com/top-10-african-startups-that-raised-over-10-million-in-funding-in-2024/