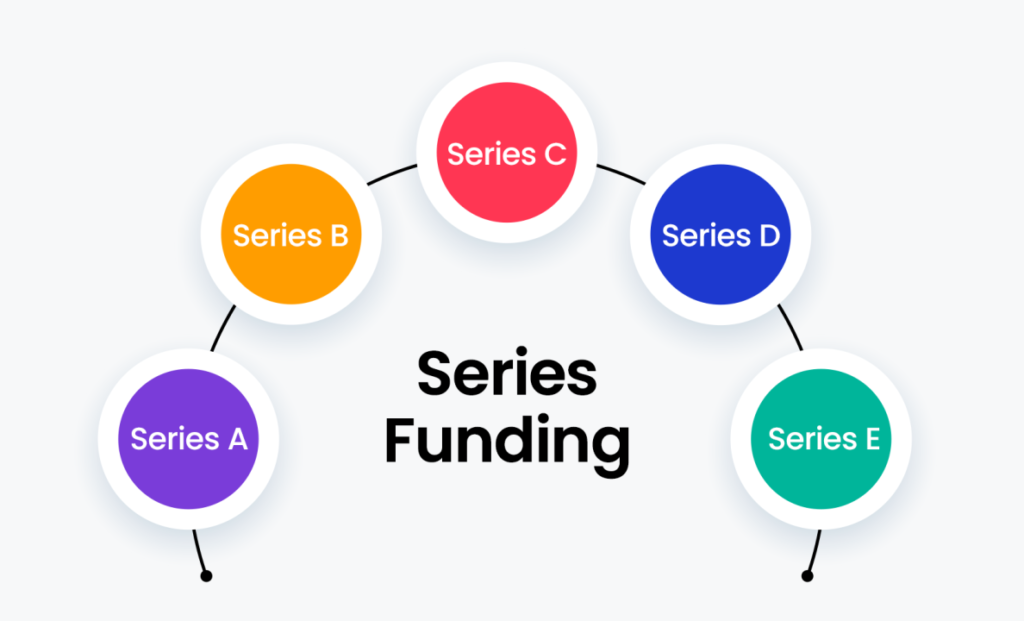

The journey from a fledgling idea to a thriving business often hinges on securing the right financial backing at critical stages of growth.

As African startups increasingly capture the attention of global investors, it becomes imperative for founders to grasp the nuances of funding rounds—Series A, B, C, D, and E.

Each stage presents unique opportunities and challenges that can significantly influence a startup’s trajectory.

We’ll break down the different series of funding—A, B, C, D, and E—that are crucial for the growth of African startups. We’ll explore what each funding round entails, typical amounts raised, and highlight some notable examples from the continent.

The Importance of Startup Funding

Startup funding is the lifeblood of any new venture. It helps businesses develop their products, expand their operations, and reach new markets. For African startups, securing funding is especially vital as it can propel them from humble beginnings to significant players on the global stage.

That said, entrepreneurs and stertups hoping to draw in investors and successfully grow their companies must comprehend the nuances of each funding round.

#1. Series A Funding

Series A funding is often the first significant round of investment that a startup receives after seed funding. Startups benefit greatly from this phase as it helps them polish their product and build a strong brand.

Typically, startups can expect to raise between $2 million and $15 million during this round, depending on their industry and growth potential.

Key Characteristics

Investors at this stage look for startups with demonstrated traction—meaning they have a viable product that customers are already using. They also seek a clear growth strategy and a strong founding team.

Examples of Successful Series A Funding in Africa

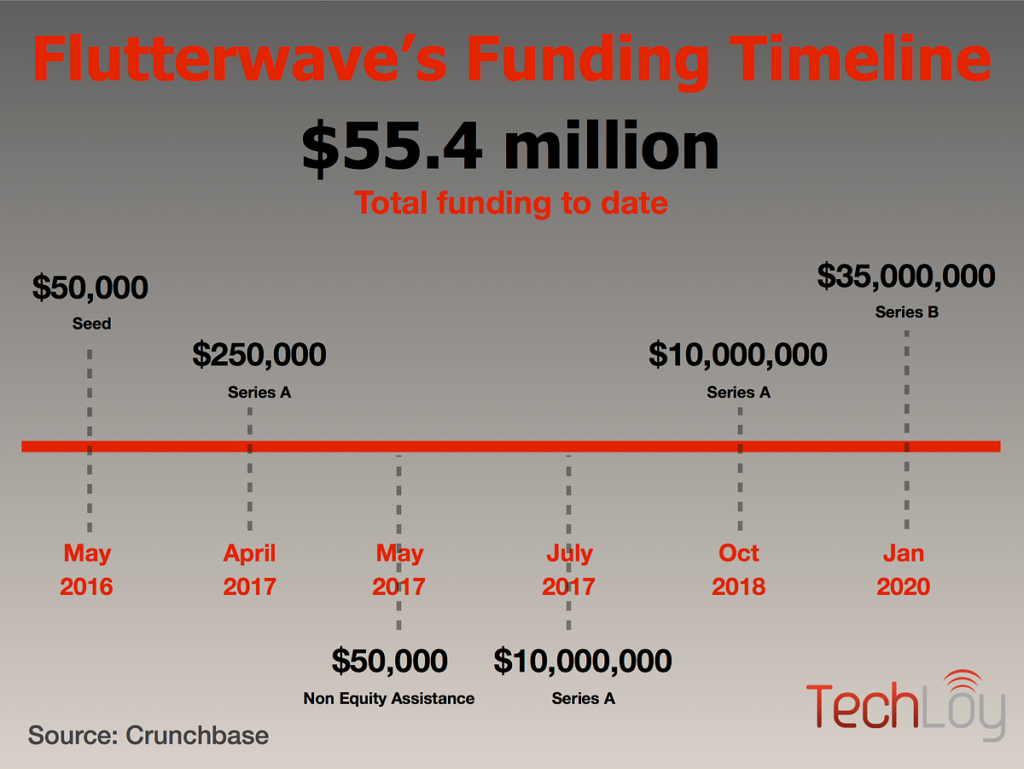

- Flutterwave (Nigeria) raised $10 million in 2017 to enhance its payment solutions across Africa.

- Twiga Foods (Kenya) secured $10.3 million in 2017 to improve its technology and expand its vendor network.

- Andela, which focuses on training software developers, raised $40 million in its Series C round but started with a strong Series A that set the stage for its rapid growth.

#2. Series B Funding

Series B funding is all about scaling operations. Startups that reach this stage have usually proven their business model and are looking to expand significantly.

In Series B rounds, startups typically raise between $10 million and $30 million, which allows them to hire key employees and enhance their marketing efforts.

Key Characteristics

Investors want to see that the startup has a solid customer base and is ready to grow beyond its initial market. This often involves expanding into new geographical areas or launching new products.

Examples of Successful Series B Funding in Africa

- Andela, after its successful Series A, continued its momentum by raising $24 million in Series B funding in 2016.

- Paga (Nigeria) raised $13 million in 2015 to further develop its mobile payment platform.

#3. Series C Funding

At this stage, startups are looking for substantial capital to continue scaling operations or to prepare for an exit strategy such as an IPO.

Series C funding can bring in anywhere from $30 million to over $100 million, depending on the startup’s ambitions.

Key Characteristics

Investors at this level are often looking for established companies with clear paths to profitability and strategic growth plans.

Examples of Successful Series C Funding in Africa

- Jumia (Nigeria) raised over $196 million in Series C funding as it prepared for its IPO.

- Paystack, another Nigerian fintech company, raised significant amounts leading up to its acquisition by Stripe after demonstrating robust growth metrics.

#4. Series D Funding

Series D funding is typically aimed at further expansion or preparing for an IPO. Startups at this stage have usually established themselves but need additional capital to reach their next milestones.

Funding amounts can vary widely but often exceed $50 million, depending on the company’s needs.

Key Characteristics

Investors expect significant traction and revenue generation at this stage. They also look for detailed plans regarding how the funds will be used to achieve specific growth targets.

Examples of Successful Series D Funding in Africa

- Interswitch (Nigeria) raised over $100 million in 2021, positioning itself as a leader in digital payments across Africa.

- OPay (Nigeria) has also secured substantial rounds aimed at expanding its services across multiple countries.

#5. Series E Funding

Series E funding is generally reserved for late-stage growth or preparing for acquisition or IPO. Companies at this level are well-established but may need additional funds to solidify their market position.

This round can involve raising upwards of $100 million, catering to significant operational expansions or acquisitions.

Key Characteristics

Investors expect proven business models with clear exit strategies. They also look for companies that have demonstrated resilience in their markets.

Examples of Successful Series E Funding in Africa

- Kobo360 (Nigeria) raised substantial funds during its later rounds as it expanded logistics services across Africa.

- Interswitch, again notable for its robust growth trajectory, has attracted significant investment aimed at further expansion.

Conclusion

Understanding the different stages of startup funding—Series A through E—is crucial for entrepreneurs navigating the African startup landscape. Each round presents unique opportunities and challenges that can significantly impact a startup’s trajectory.

As African startups continue to innovate and attract attention from global investors, it’s essential for founders to seek appropriate funding at each stage of their journey.

The future looks promising for startup funding in Africa as more venture capital firms recognize the continent’s potential.For more insights on navigating startup funding in Africa, check out resources like Daba Finance or TechCabal which provide valuable information tailored for entrepreneurs looking to thrive in this dynamic ecosystem.

Read More: