Top Funded Startups in Africa: Driving Innovation and Growth

Africa’s startup ecosystem is experiencing remarkable growth, with innovative companies springing up across the continent. In 2024, African startups raised over $780 million in funding, despite a challenging global economic climate. This funding is crucial to develop their products, expand their reach, and compete on a global stage.

For instance, Moove from Nigeria raised $100 million, while M-KOPA from Kenya secured $51 million, and other which we cover below.

These investments highlight the immense potential of the continent’s entrepreneurial spirit and the importance of continued support for these ventures.

Let’s breifly look at those startups.

1) M-KOPA (Kenya): $51 million

In 2024, M-KOPA secured $51 million in a Series D funding round. This round was led by CDC Group, with participation from Generation Investment Management, LGT Venture Philanthropy, and Energy Access Ventures. The funding will be used to scale M-KOPA’s operations, expand into new markets, and develop new products that further enhance energy access across Africa.

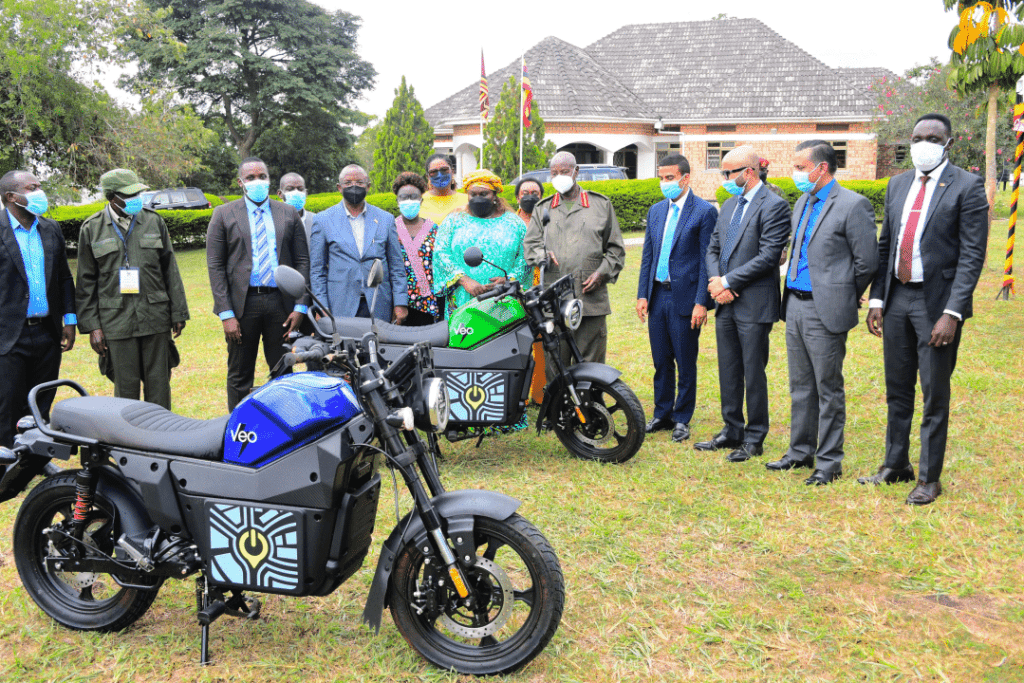

2) Roam (Kenya): $24 million

Roam secured $24 million in a Series B funding round in 2024. The round was led by Silicon Valley-based At One Ventures, with participation from Factor[e] Ventures and the IFC (International Finance Corporation). This funding will enable Roam to scale its manufacturing capabilities and expand its electric vehicle offerings.

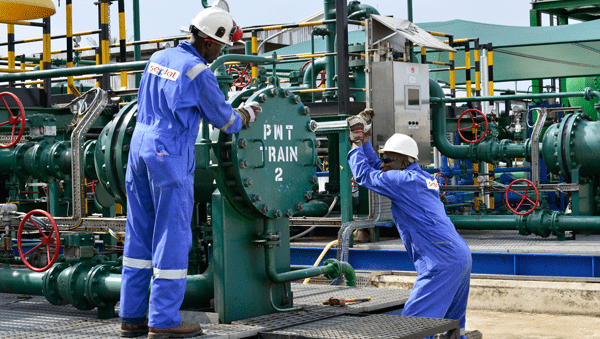

3) Moove (Nigeria): $100 million

In 2024, Moove raised $100 million in a Series B funding round. The round was led by Speedinvest and included participation from Left Lane Capital, thelatest.ventures, and FMO, the Dutch entrepreneurial development bank. This significant investment will enable Moove to expand its services to more cities across Africa and enhance its product offerings.

4) VaIU (Egypt): $18.7 million

In 2024, VaIU raised $18.7 million in a Series B funding round. The round was led by HealthTech Capital, with participation from Flat6Labs and A15. This funding will be used to expand VaIU’s telemedicine platform, develop new digital health tools, and enhance its reach in rural and underserved communities.

5) SunCulture (Kenya): $27.5 million

In 2024, SunCulture raised $27.5 million in a Series C funding round. The round was led by Energy Access Ventures and included participation from EDF Group, Acumen, and the Shell Foundation. The funding will be used to scale SunCulture’s operations, expand its product range, and reach more farmers across Africa.

6) Pula (Kenya): $20 million

In 2024, Pula raised $20 million in a Series B funding round. This round was led by TLcom Capital, with participation from Allianz X and the Women’s World Banking Asset Management. The investment will support Pula’s efforts to reach more farmers, develop new insurance products, and enhance its technological capabilities.

7) SPIRO (Kenya): $50 million

SPIRO raised $50 million in 2024 in a Series B funding round. The round was led by EAV Capital, with participation from Social Capital and Breakthrough Energy Ventures. This investment will support SPIRO’s expansion plans across East Africa and the development of advanced electric mobility solutions.

8) Planet42 (South Africa): $16 million

In 2024, Planet42 raised $16 million in a Series B funding round. The round was led by Naspers Foundry, with participation from Change Ventures and Startup Wise Guys. This funding will enable Planet42 to scale its operations, expand its car fleet, and enter new markets.

9) Simera Sense (South Africa): $15 million

Simera Sense secured $15 million in a Series A funding round in 2024. The round was led by NewSpace Capital, with participation from HAVAÍC and Convergence Partners. The investment will support Simera Sense’s efforts to enhance its satellite imaging technology, expand its product offerings, and reach more customers globally.

10) OneOrder (Egypt): $16 million

In 2024, OneOrder secured $16 million in a Series A funding round. The round was led by FMO, the Dutch entrepreneurial development bank, with participation from Sawari Ventures and Algebra Ventures. The investment will help OneOrder expand its platform, improve its technology, and reach more food service businesses across Egypt and beyond.

Sector Analysis

Several sectors in the African startup ecosystem have attracted significant investment, including FinTech, HealthTech, Agritech, and Clean Energy.

FinTech continues to dominate, with startups like Moove and Planet42 leading the way. The sector’s growth is driven by the increasing demand for financial inclusion and digital financial services. According to Disrupt Africa, African FinTech startups raised over $2.7 billion in the last two years, a trend that has continued to rise in subsequent years.

HealthTech startups like VaIU and Pula are also gaining traction, leveraging technology to improve healthcare access and outcomes. The COVID-19 pandemic has accelerated the adoption of digital health solutions, highlighting the need for innovative approaches to healthcare delivery.

According to a report by UNDP, Africa’s digital health market is projected to reach $11 billion by 2025, emphasizing the growing importance of health technology.

Agritech is another booming sector, with companies like SunCulture and Pula providing solutions to enhance agricultural productivity and sustainability. As agriculture remains a critical part of the African economy, innovations in this sector are crucial for food security and economic development.

Clean Energy startups, such as M-KOPA and SPIRO, are addressing the continent’s energy challenges by providing sustainable and affordable energy solutions. The push towards renewable energy is essential for reducing carbon emissions and ensuring energy access for all.

These sectors’ popularity can be attributed to their potential to address pressing challenges and drive significant social and economic impact.

Related Posts: