Nigerian fintech startup Billboxx has successfully raised $1.6 million in pre-seed funding, marking a significant step toward solving cash flow challenges faced by small and medium-sized enterprises (SMEs) across Africa.

This milestone positions Billboxx as a transformative force in the continent’s business landscape, combining technology with tailored solutions for SME growth.

Investors Back Billboxx’s Vision for African SMEs

Prominent investors, including Norrsken Accelerator, Kaleo Ventures, 54 Collective (formerly Founders Factory Africa), P2Vest, and Afrinovation Ventures, participated in the funding round. Each investor expressed confidence in the company’s innovative approach to solving persistent cash flow issues.

Alex Bakir, General Partner at Norrsken Accelerator, highlighted the importance of Billboxx’s mission, stating, “The team has experienced first-hand the challenges associated with invoices and payments and is committed to building solutions that simply work for small businesses across the continent. We’re proud to support Justus, AZ, and the team, and see huge potential in financial solutions Billboxx is developing.”

Similarly, Bongani Sithole, CEO of 54 Collective, noted the strong foundation laid by the founders, saying, “These 3x founders with successful exits under their belts are leveraging their leadership and business experience to tackle a massive pain point for SMEs across Africa. We invested in the company due to the large market size of the opportunity, impressive early traction, and solid tech product development.”

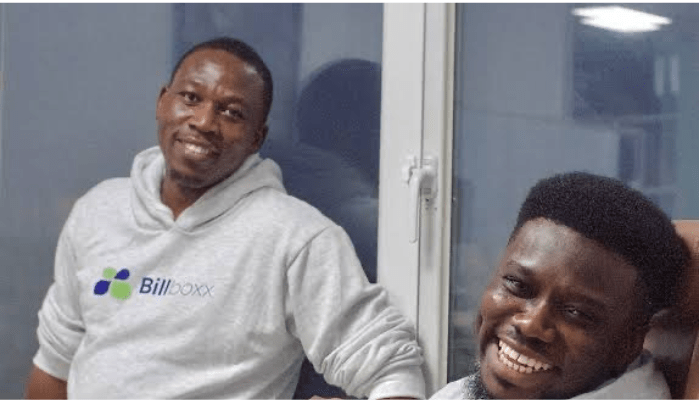

Founders Bring Expertise and Vision

Co-founders Justus Obaoye and Abdulazeez Ogunjobi bring a wealth of entrepreneurial and leadership experience to Billboxx. Their earlier ventures, Charistouch (Carido), later acquired by Cars45, and Fixit45, a spin-off from Cars45, have cemented their reputation as strategic innovators.

Obaoye emphasized the company’s mission, explaining, “Cash flow difficulties are the leading cause of business failures in Africa, with delayed invoice payments being a major contributor.”

Innovative Solutions for Cash Flow Management

Billboxx offers an integrated billing-to-payment platform that automates billing processes, reduces inefficiencies, and minimizes the impact of deferred payments.

The platform empowers African SMEs with features like automated invoicing, secure payment facilitation, and customized cash flow financing.

Since its launch in early 2023, the company’s Minimum Viable Product (MVP) has already facilitated over $4 million in invoice payments, underscoring its potential to transform SME operations across the continent.

The Path Forward for African SMEs

Manual invoicing and delayed payments often hinder the growth of African SMEs. Billboxx aims to eliminate these barriers by streamlining payment processes and providing tools that enable consistent cash flow.

This strategic approach allows SMEs to focus on scaling their operations rather than grappling with financial roadblocks.

With this fresh funding, Billboxx is poised to expand its reach, deepen its impact, and empower more businesses to thrive in Africa’s competitive economic environment.

Read More: